Online Construction Equipment Breakdown Insurance

Construction equipment breakdown insurance protects commercial buildings and equipment from specific perils, while the building is under construction. If the unexpected occurs, don’t risk paying steep costs out of pocket, and protect yourself with construction equipment breakdown insurance today.

Property Damage or Equipment Breakdown Insurance – Included

Soft Costs Coverage – Optional

Temporary Equipment Rental – Optional

Delayed Start-Up – Optional

Click Here to read descriptions and explanations.

These policies are designed to be more economical due to less personnel handling being required. Once a policy is purchased online, any changes needed will result in extra administration charges for processing.

Who Needs Construction Equipment Breakdown Insurance?

Will you be building a new frame building? Construction Equipment Breakdown Insurance pays for the repair or replacement of the building and equipment due to accidental breakdown while the buildings are under construction. Limits of Insurance are based on the final replacement cost new value of the building, like the Builder’s Risk policy.

Refer to the Eligible Projects tab below to see the types of buildings that can be insured under this Online Construction Equipment Breakdown insurance.

Eligible Projects

Businesses that are building the following are encouraged to protect themselves with this insurance.

- New Construction

- Renovations and additions excluding existing structures

- Only Wood Frame Construction

- Single Family Homes

- Multi Family Residential up to 8 Family units

- Light Commercial Buildings

- Up to 4 Story buildings

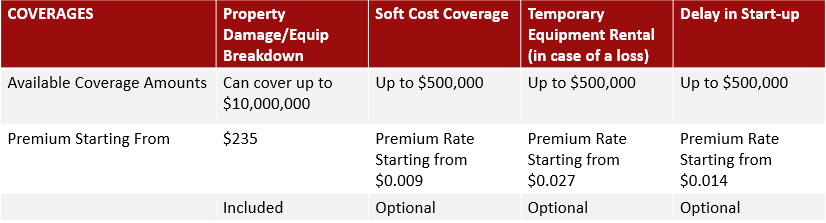

Coverage / Limit Amounts

The following are the specific limit options available to you, depending on the coverage(s) you choose to purchase.

Limit/Coverage Amount– choose the highest amount the insurer will pay in the case of a claim.

Premium – the starting amount you would pay to cover your risk.

Additional Coverages and Extensions Automatically included with your policy:

- Property in Transit $100,000

- Temporary Structures $100,000

- Scaffoldings, Construction Forms and Temporary Fences $100,000

- Fire Department Charges $25,000

- Debris Removal up to $100,000

- Pollutant Cleanup and Removal $50,000

- By Laws: Demolition Cost $100,000

- By Laws: Increased Cost of Construction $100,000

- Inflation Protection $50,000

- Extra and Expediting Expense $50,000

- Valuable Papers, Plans and Records and Software $25,000

Construction Equipment Breakdown Coverages Explanations

Property Damage or Equipment Breakdown Insurance – Included

Construction equipment breakdown insurance covers key gaps in Builder’s risk property policies. All kinds of equipment are vulnerable to a wide range of breakdown risks during construction. The breakdown of equipment can result in costly damage to the equipment, loss of revenue, interrupted operations and delays, and additional costs to repair or replace.

What are some examples of what can go wrong under construction?

- Air conditioning systems – Many parts that could breakdown. For example, the compressor motor

- Electrical systems – Parts are interconnected meaning a single accident could escalate to damaging multiple sections.

- Underground cables – Electrical arcing and short circuits could occur for many reasons.

- Heating Systems – May fail while testing or during early operation and can cause damage to the building.

- Building Automation Systems – Sensitive to power surges and electrical disturbances.

These potential breakdowns can result in the loss of power and damage. Not only this, but insured losses usually add up to more than $100,000.

Soft Costs Coverage – Optional

Soft costs are expenses not considered a direct construction cost of the building. For example, soft costs include professional and administration fees, marketing, permit and taxes, financing costs, engineering, and legal fees that may have to be re-incurred in the event of a loss. If the project is damaged, soft costs make up a significant expense to the project owner, which are not considered in the equipment breakdown policy.

Temporary Equipment Rental – Optional

In the unfortunate case that a breakdown occurs to your equipment, this coverage pays to rent temporary equipment to help finish the job on time. This can be essential if your business suffers from an electrical breakdown.

Delayed Start-Up – Optional

If there is a delay in starting construction, delayed startup insurance covers the loss of income that would have been earned if the project was on schedule. What does it cover? It covers the loss of rental income, expenses, or recoveries that would have been provided by the tenants, and parking as well.

For more information and claims examples as provided by the insurer Boiler Inspection & Insurance Co, click here.

* All insurance coverage described is intended to be general in nature and subject to the applicable insurer’s specific policy wording, terms, conditions and exclusions.